Award-winning PDF software

How to prepare 941 Form 2021

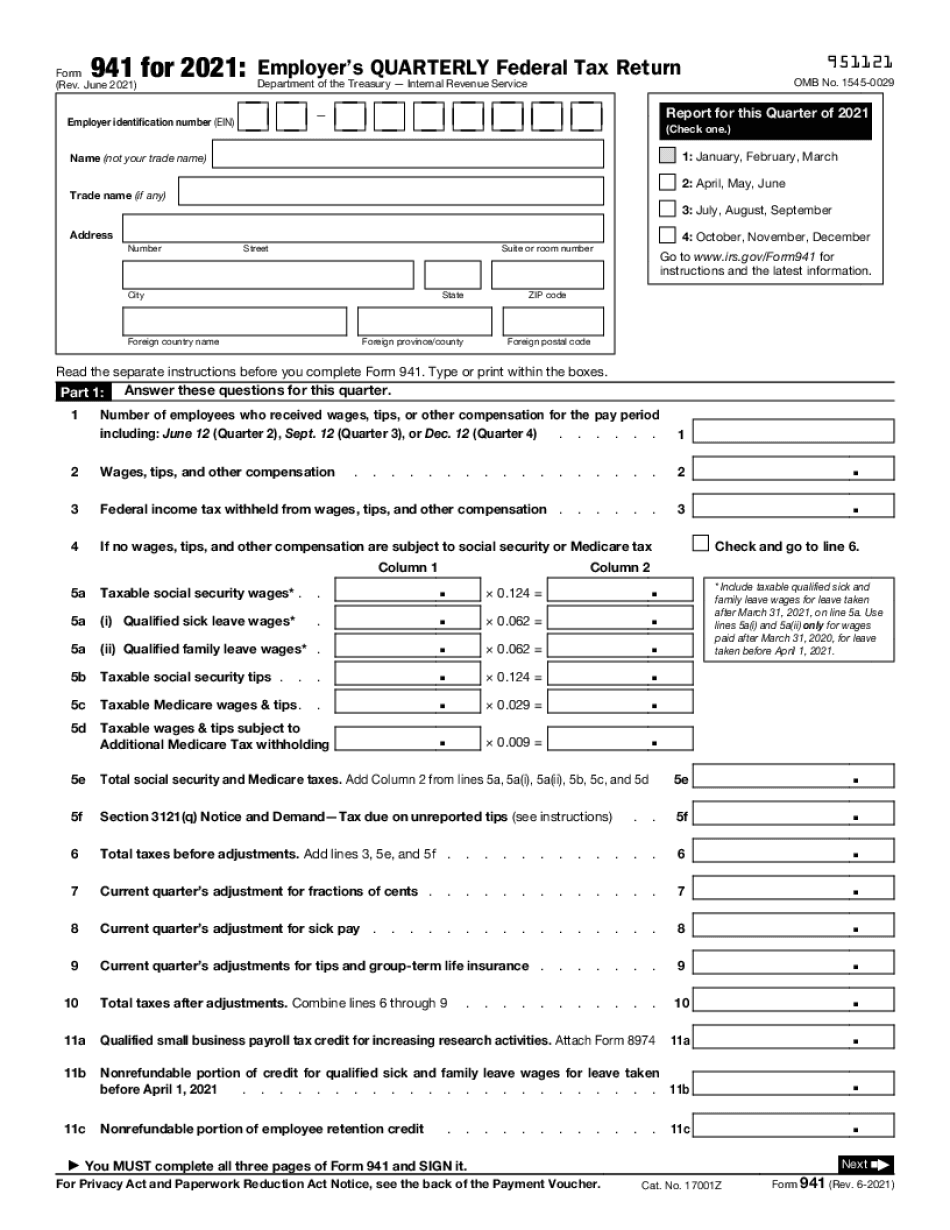

About 941 Form 2021

Form 941 for the year 2024 is a quarterly tax return form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employees' wages. It also allows employers to report their portion of Social Security and Medicare taxes. This form is filed by employers who are required to withhold income taxes and pay Social Security and Medicare taxes on behalf of their employees. Employers who pay wages to employees, including those who have household employees, agricultural employees, or employees of nonprofits, are generally required to file Form 941. However, there are certain exceptions, such as agricultural employers with annual employment tax liability of $1,000 or less, employers with no employees during the quarter, or those who file Form 944 instead. Form 941 provides information on employee wages, tips, federal income tax withheld, Social Security and Medicare taxes withheld, and the employer's portion of Social Security and Medicare taxes. It is used to reconcile the amounts reported and paid during the quarter and calculate the employer's share of these taxes. It's important for employers to accurately complete and submit Form 941 on time to ensure compliance with tax obligations and avoid penalties. The due dates for filing Form 941 are typically the last day of the month following the end of each quarter (April 30, July 31, October 31, and January 31 for the subsequent year).

Get 941 Form 2024 and make simpler your day-to-day file managing

- Find 941 Form 2021 and start modifying it by clicking on Get Form.

- Start completing your form and include the data it requires.

- Make the most of our extended modifying toolset that lets you post notes and leave feedback, as needed.

- Take a look at form and check if the information you filled in is right.

- Easily fix any error you have when modifying your form or go back to the previous version of your document.

- eSign your form effortlessly by drawing, typing, or taking a photo of your signature.

- Save modifications by clicking Done and after that download or send your form.

- Submit your form by email, link-to-fill, fax, or print it.

- Choose Notarize to carry out this task on the form on the internet with the eNotary, if needed.

- Securely store your complete document on your PC.

Editing 941 Form 2024 is an easy and user-friendly procedure that requires no prior coaching. Discover all you need in one editor without the need of constantly changing in between various solutions. Find much more forms, complete and preserve them in the formatting of your choice, and enhance your document managing in a single click. Prior to submitting or delivering your form, double-check information you filled in and easily fix mistakes if needed. In case you have inquiries, get in touch with our Customer Support Team to help you out.